Drop Your Block Here

Join Our Advanced Tax Strategies Webinar! >>

Drop Your Block Here

MAKE YOUR MONEY

WORK AS HARD AS YOU DO

You spent a lifetime saving,

now make it worth it!

Drop Your Block Here

Why the Right Tax & Mitigation Strategies are Essential for Wealth Preservation!

15-Minute Checkup

In today's economic environment, high-net-worth and high-income earners face multiple threats that could destroy their wealth. These individuals have to deal with very complex financial scenarios, multiple income streams, investment portfolios, real estate holdings, and often, international transactions. These situations have unique tax implications, requiring careful handling and strategic tax planning to ensure legal compliance and tax reporting. We help you navigate the complex landscape of taxation law and regulations. With the constantly changing tax codes, it is easy to miss crucial deductions or credits, pay more than necessary, or make errors that could lead to penalties and audits.

Moreover, high-net-worth individuals often have more at stake and, thus, more to lose. Poor tax planning and management can result in substantial financial losses, missed investment opportunities, or unfavorable impacts on estate planning. We help you identify opportunities to implement tax strategies that help you preserve your wealth and minimize your tax burden. We provide expert tax advice, strategic planning, and tax mitigation services.

Are You Looking for a Tax Professional?

- Struggling with understanding and navigating the complex world of tax laws and regulations; especially as they pertain to high earners and high net-worth individuals?

- Are you concerned about the impact of taxes on your wealth and income?

- Want to ensure you are paying only what is necessary and effectively preserving your wealth for future generations?

- Would you like to save time and effort coming up with new ideas by implementing tax strategies that have stood the test of time and have been used by wealthy individuals and families for decades?

- Are you looking for highly skilled and trusted tax professionals who can customize a solid solution based on your specific situation, helping you develop a tax strategy that's legal, ethical, and effective?

Drop Your Block Here

OUR CORE TAX STRATEGIES

The Following Strategies Should be Administered by Qualified Professionals.

We Work With a Team of Tax Professionals to Help You Organize, Setup and Execute The Below Listed Strategies.

Schedule a Meeting With One of Our Tax Professionals to Help You Start Your Tax Savings Journey.

Mezzanine Offers

In tax planning, a mezzanine offer typically refers to a financial strategy combining debt and equity instruments to optimize tax benefits. The term "mezzanine" generally refers to a middle layer or intermediate stage, and in tax planning, it represents a hybrid financing structure.

Learn More...

Charitable LLC

A Charitable Limited Liability Company (LLC) is a specific business entity that combines elements of a traditional LLC with a nonprofit organization's charitable purposes and activities. It is designed for individuals or groups wishing to pursue social or charitable goals and profit-making activities within a single legal structure.

Learn More...

Charitable Leveraged Deductions

There are benefits to being a philanthropist and paying back to your community.

Learn More...

Navigating the Complexities of 831(b) Risk & Tax Mitigation Strategies

Get a Step-by-Step Guide for High-Net-Worth Individuals & High Income Earners. Everything You MUST Know About Using 831(b) To Save On Taxes

Learn More...

Deferred Sales Trust

A Deferred Sales Trust (DST) is a tax strategy that lets property or business owners sell their assets while deferring capital gains tax over a structured period. This legal and flexible strategy is often used by people who want to sell highly appreciated assets but want to avoid the significant capital gains taxes from a direct sale.

Learn More...

Qualified Plan Exit

A Qualified Plan Exit Strategy is a method for handling one's retirement savings upon leaving a company or retiring, particularly regarding a qualified retirement plan such as a 401(k), 403(b), or traditional IRA. Qualified plans are employer-established retirement plans that meet specific IRS criteria for tax advantages.

Learn More...

Defined Benefit Plans

A Defined Benefit Plan, often called a pension plan, is an employer-sponsored retirement plan where employee benefits are computed using a fixed formula. This formula usually factors the employee's final average salary, years of service, and a specific percentage rate.

Learn More...

Cash Balance Plan

A Cash Balance Plan is a defined benefit retirement plan that can be a powerful tax savings tool for businesses and self-employed individuals. It allows for more significant tax-deductible contributions than other types of retirement plans, such as a 401(k) or a Simplified Employee Pension (SEP) plan.

Learn More...

Restricted Property Trust (RPT)

A Restrictive Property Trust is a strategy business owners and high-income earners use to reduce income tax liability, protect assets, and provide a death benefit. Here's a simplified breakdown.

Learn More...

Bonus Depreciation

Deduct a Large of the Purchase Price of Eligible Business Assets...stimulus to encourage businesses to buy equipment and invest in themselves, which could help stimulate economic growth.

Learn More...

It is highly recommended that all combinations of this strategy be implemented by a licensed and experienced professional.

What is Tax Mitigation?

Mitigation strategies can range from maximizing deductions and tax credits, to strategically timing income and expenditures, to taking advantage of tax-advantaged investment vehicles.

Mitigation strategies can range from maximizing deductions and tax credits, to strategically timing income and expenditures, to taking advantage of tax-advantaged investment vehicles.

For high-net-worth individuals and high-income earners, tax mitigation is not just an option but a crucial aspect of wealth management. Here are a few key reasons why:

- Wealth Preservation: By reducing tax liability, affluent individuals can preserve and grow their wealth over time. More money retained means more capital that can be reinvested to generate further wealth.

- Legal Compliance: Proper tax mitigation strategies ensure that high net-worth individuals stay within the boundaries of the law while minimizing their taxes. This is essential for avoiding penalties, audits, and potential legal issues that could arise from non-compliance.

- Effective Resource Utilization: The money saved through tax mitigation can be redirected towards more productive uses, such as investment in businesses, philanthropy, or wealth transfer strategies.

- Long-Term Planning: Tax mitigation is an integral part of estate planning and succession strategies for the affluent. Understanding and controlling their tax liabilities allow these individuals to maximize the wealth transferred to the next generation.

- Financial Flexibility: Effective tax mitigation can provide increased financial flexibility, allowing high net-worth individuals to respond to market changes, pursue new investment opportunities, or address unforeseen expenses.

Schedule a Consultation

Drop Your Block Here

(470) 863-1800

Drop Your Block Here

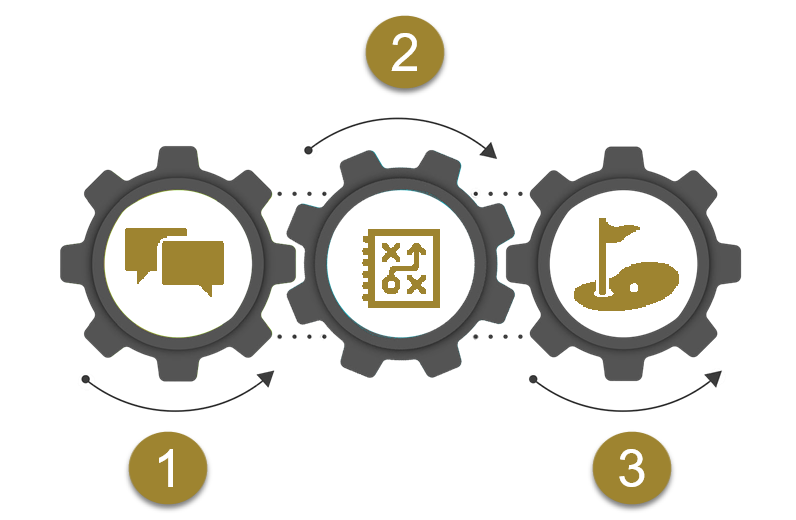

GET STARTED IN

3 Easy Steps...

Step 1 - Schedule a Discovery Session

In this initial phase, it's crucial to understand your current financial and tax situation. This includes reviewing your income sources, investments, deductions, previous tax returns, and any current strategies you've implemented. It sets the groundwork for developing a personalized tax mitigation plan.

Step 2 - Evaluate Your Current Plan

The next step involves evaluating the effectiveness of your existing tax strategies and identifying opportunities for improvement. This includes comparing your current plan with those used by the affluent and super-wealthy, looking for gaps, potential risks, and areas where you might not be fully utilizing available tax advantages.

Step 3 - Get Your Customized Plan

The final phase is to develop and implement a tailored tax mitigation plan. This involves choosing the best strategies from those used by the affluent and super-wealthy, aligning them with your personal and financial goals, and setting up a schedule for regular review and adjustment based on changes in tax laws and your personal circumstances.

Schedule a Discovery Session Today!

($497 Value)

Drop Your Block Here

There Are No Blog Posts To Show In The RSS Link You've Provided,

Please Try A Different Blog Posts RSS Link

Drop Your Block Here

How Market Conditions Impact Taxes!

- Learn What's Considered a Market Correction? Although a market correction can be a precursor to a bear market or recession, that’s not always the case.

- What Triggers a Market Correction? Learn the several factors that may play into a market correction.

- What Does a Market Correction Mean for My Investments & Taxes? Don’t panic! Learn what you can do In the event of a stock market correction.

DOWNLOAD NOW

Removed Automation Delay

Added Automation Delay

Drop Your Block Here

ABOUT US

As tax and wealth strategists, we help high-net-worth and high-income earners navigate the complex landscape of taxation law and regulations. Our 15-minute assessments will give you insight into principals-based tax strategies that will transform your tax and mitigation experience!

REACH US

Support: consult@OneAtlantaTaxSolutions.com

PHONE

(470) 863-1800

LOCATION

1275 Shiloh Road, Suite 2220

Kennesaw, GA 30144

FIND US

© 2024 One Atlanta Tax Solutions All Rights Reserved. 1275 Shiloh Rd NW #2220, Kennesaw, GA 30144 . Contact Us . Terms of Service . Privacy Policy

Drop Your Block Here